Top 10 Best Passive Income Ideas in January 2025

Looking to make money while you sleep? We’ve got you covered. From rental properties and dividend stocks to creating digital products and affiliate marketing, this listicle is packed with top-notch passive income ideas that can help you secure a steady stream of cash flow without breaking a sweat. Whether you’re a savvy investor or an aspiring entrepreneur, these strategies are designed to maximize your earnings potential and set you on the path to financial freedom.

Ready for some game-changing money-making opportunities? Scroll down for reviews of our top picks and start turning your idle assets into active sources of income today!

1. Dividend Stocks

Dividend stocks offer a consistent income source derived from company dividends, making them attractive for passive income seekers. This investment avenue not only provides regular payouts but also the potential for capital appreciation over time, offering a dual benefit to investors.

Investing in dividend stocks can be an excellent choice for those looking to build a long-term passive income stream without active involvement in day-to-day operations. Many investors opt for dividend stocks due to their stability and reliability in generating returns steadily.

2. Rental Properties

Owning rental properties is a smart way to generate passive income effortlessly. By leasing out your property, you receive regular rent payments without actively working for it. This steady stream of revenue can serve as an additional source of income or even fund your retirement.

Real estate investments come with the added benefit of potential property value appreciation over time. As the housing market fluctuates, your asset could increase in worth, offering you more significant returns on your initial investment. While there are upfront costs and ongoing management duties involved in owning rental properties, the financial rewards can be substantial.

Investing in rental properties not only secures a stable income but also allows you to diversify your assets effectively. It’s like having a storage space that generates money for you continuously without requiring constant attention or effort on your part. With the right property and management strategies in place, this passive income stream can significantly boost your overall financial portfolio.

3. High-Yield Savings Accounts

High-yield savings accounts are an excellent choice for individuals seeking to grow their money passively. These accounts boast higher interest rates compared to traditional savings accounts, making them ideal for those looking to earn more on their extra cash.

With high-yield savings accounts, your funds remain easily accessible whenever you need them. This accessibility ensures that you can reach your financial goals without worrying about withdrawal restrictions or penalties.

For young adults or anyone with a low-risk tolerance, these accounts provide a safe and reliable option to generate additional income. By leveraging the competitive interest rates offered by high-yield savings accounts, individuals can watch their money work harder for them without taking on unnecessary risks.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms offer a unique opportunity to earn passive income through interest payments on loans facilitated between individuals. By leveraging these platforms, investors can bypass traditional financial institutions and potentially achieve higher returns.

This investment avenue functions as a passive income source once the initial private equity is invested. The process involves lenders receiving payouts in the form of interest as borrowers repay their loans over time. As each loan or bond matures, investors receive both their principal amount back along with accumulated interest.

One key advantage of peer-to-peer lending is its ability to diversify your investment portfolio beyond stocks and bonds. It allows you to spread risk across various borrowers rather than relying on a single entity for returns.

5. Create an Online Course

Creating an online course allows you to share your expertise and earn passive income from course sales. The rise of e-learning platforms has made it easier than ever for experts to monetize their knowledge by creating courses tailored to a global audience.

Online courses have become increasingly popular due to the flexibility they offer both instructors and students. Instructors can create content once and reach thousands of learners, while students have the freedom to learn at their own pace, fitting education into their busy schedules.

Once your online course is up and running, it can generate passive income as students enroll and progress through the material. This means that even when you’re not actively promoting or updating the course, you can still earn money from new enrollments.

6. Write and Publish an eBook

Self-publishing an eBook allows you to earn royalties directly from sales, bypassing traditional publishers. The production costs for eBooks are minimal compared to printed books, making it a cost-effective way to generate passive income.

By leveraging platforms like Amazon Kindle, your eBook can reach a vast audience globally, increasing your chances of earning substantial royalties over time. This method is particularly advantageous for individuals with writing skills looking to monetize their content efficiently.

Writing and publishing an eBook not only provides a source of passive income but also establishes you as an expert in your field. Readers perceive authors as knowledgeable authorities on the topics they write about, enhancing the value of your brand or expertise within that niche market.

7. Affiliate Marketing

Affiliate marketing involves promoting products or services to earn a commission when your audience makes a purchase through your referral link. To succeed in this passive income stream, you need to build a loyal following and strategically place affiliate links within your content.

By focusing on a specific niche that resonates with your audience, you can increase the chances of generating more clicks and conversions. Crafting engaging content that seamlessly integrates these links is crucial for driving sales without coming across as too pushy or sales-oriented.

The key lies in developing a solid marketing strategy that aligns with the interests of your followers. As your audience grows and engages with the products or services you recommend, you’ll start seeing an increase in passive income from the commissions earned through successful referrals.

Remember, consistency is vital in affiliate marketing; nurturing relationships with your audience over time can lead to higher conversion rates and more substantial earnings. Keep analyzing what works best for your unique following and adjust your strategies accordingly to maximize revenue potential.

8. Create a Blog or YouTube Channel

Starting a blog or YouTube channel can be a lucrative way to earn passive income through ads, sponsorships, and product promotions. By consistently producing valuable content and growing your audience, you set the stage for generating passive income from these platforms.

A successful blog or YouTube channel serves as a reliable source of passive income over time. With dedication and strategic content creation, you can build a substantial following that translates into sustainable earnings. Remember that quality content is key to attracting viewers and keeping them engaged.

For blogs, consider niches with high demand but low competition to stand out in the crowded online space. Research popular topics within your niche and create well-designed posts that offer value to readers.

Focus on creating engaging videos that cater to your target audience’s interests. Consistency in posting new video content is crucial for maintaining viewer interest and growing your subscriber base.

Whether you choose blogging or vlogging on YouTube (or both), patience is essential as building an online presence takes time. Stay committed to providing helpful content, interact with your audience regularly, and explore different monetization strategies as your platform grows.

9. Sell Digital Products

Creating and selling digital products such as e-courses, templates, or software is a lucrative business model for generating passive income. These products can be developed once and sold repeatedly without the hassle of physical inventory or shipping requirements. By leveraging online platforms to sell digital products, you can tap into a vast global market effortlessly.

Selling digital products eliminates the need for customers to wait for shipping; they can instantly access their purchases upon payment completion. This immediacy enhances customer satisfaction and increases the likelihood of repeat purchases.

Digital products are not constrained by physical limitations like traditional goods, allowing you to set competitive prices based on demand rather than production costs. Moreover, through analytics tools provided by online platforms, you can gain insights into customer behavior and preferences to refine your product offerings further.

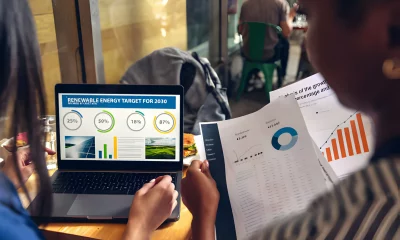

10. Invest in Crowdfunded Real Estate

Crowdfunded real estate platforms are avenues where investors combine their resources to participate in real estate ventures. This investment method requires lower capital compared to owning a property outright, making it more accessible for many individuals looking to invest passively.

Investing in crowdfunded real estate can yield returns through two primary channels: rental income and property value appreciation. Rental income is generated when the property is leased out, providing a steady stream of passive earnings over time. As the real estate market fluctuates, the value of the property can increase, allowing investors to profit from selling their shares at a higher price.

This option allows investors to diversify their portfolios without needing extensive knowledge or experience in real estate management. Moreover, it offers an opportunity for individuals who may not have substantial funds on hand but still wish to benefit from the lucrative real estate market.

Closing Thoughts

You’ve now explored various avenues for generating passive income, from dividend stocks to creating online courses. Each option offers a unique opportunity to grow your wealth steadily over time. Remember, diversification is key in building a robust passive income stream. Consider mixing and matching different strategies to minimize risk and maximize returns. Take action today by delving into one or more of these ideas. Your financial future could significantly benefit from the passive income you generate.

Frequently Asked Questions

How can I start investing in Dividend Stocks?

To start investing in Dividend Stocks, open a brokerage account, research companies with a history of consistent dividend payments, and consider factors like yield and payout ratio before making your investment.

Is creating an Online Course profitable for passive income?

Creating an online course can be highly profitable for passive income if you offer valuable content that addresses the needs of your target audience. Promote your course effectively to maximize earnings.

What are the benefits of Affiliate Marketing as a passive income idea?

Affiliate Marketing allows you to earn commissions by promoting other companies’ products. It’s low-risk as you don’t need to create products yourself. With strategic marketing efforts, it has the potential for significant passive income.

Can anyone write and publish an eBook for generating passive income?

Yes, anyone with knowledge or expertise on a particular subject can write and publish an eBook. Platforms like Amazon Kindle Direct Publishing make it easy to self-publish eBooks and earn royalties from sales without ongoing effort.

How do I get started with Peer-to-Peer Lending as a source of passive income?

To start Peer-to-Peer Lending, sign up on platforms like Prosper or LendingClub, choose loans based on risk level and return rate preferences, then invest funds across multiple loans to diversify your portfolio.