Personal Finance

Top 10 Best Budget Apps in January 2025

In today’s fast-paced world, staying on top of your finances has never been more crucial. Luckily, with the rise of budgeting apps, you can now effortlessly track your expenses and savings on the go. From intuitive interfaces to handy features that simplify money management, these apps are designed to make your financial life easier.

Whether you’re a seasoned saver or just starting out on your budgeting journey, this listicle will unveil the top budget apps that cater to every financial need. Get ready to take control of your money like never before! Scroll down for reviews of our handpicked selection that will revolutionize how you handle your finances.

1. Mint: Best for Daily Budget Management

Track your daily expenses effortlessly with Mint. Set up budget categories to categorize your spending and receive alerts when you exceed them. With Mint’s intuitive interface, you can get a clear overview of your financial health at a glance.

Mint is designed to simplify money management by providing users with a comprehensive dashboard where they can plan their budgets, set financial goals, and monitor their progress throughout the month. The app offers personalized advice based on your spending patterns and helps you identify areas where you can save more effectively.

By utilizing Mint, users have access to detailed information about their finances in one convenient location. This includes insights into spending habits, income trends, and opportunities for improvement. The app also allows users to link all their financial accounts in one place for easy tracking and analysis.

With its user-friendly features and tools, Mint has been highly recommended by the editorial team at various reputable sources for its effectiveness in helping individuals take control of their finances seamlessly.

2. YNAB (You Need A Budget): Best for Zero-Based Budgeting

Embrace the zero-based budgeting method with YNAB, assigning every dollar a specific purpose. This approach ensures that all your income is allocated towards expenses, savings, or investments.

By utilizing YNAB’s tools, you can gain better control over your spending habits. The app provides real-time tracking of your transactions and helps identify areas where you can cut back on unnecessary expenses.

YNAB’s goal-setting feature is a standout offering. It allows you to set financial milestones and track your progress towards achieving them. This function serves as a motivator in sticking to your budget and reaching your desired financial objectives.

With many budgeting apps available in the market today, YNAB stands out due to its user-friendly interface and comprehensive features tailored for those looking to adopt zero-based budgeting strategies effectively.

3. PocketGuard: Best for Simplifying Your Finances

PocketGuard streamlines your finances by automatically categorizing transactions, offering valuable insights into your spending habits. This feature helps you grasp where your money is going and identify areas for potential savings.

Setting personalized spending limits within the app ensures that you stay on track with your financial goals. Receive timely notifications as you approach these limits, aiding in better budget management and preventing overspending.

The robust bank-level security measures integrated into PocketGuard provide peace of mind when linking your bank accounts and credit cards to the app. This ensures that sensitive financial information remains secure while using the platform.

With its user-friendly interface and cost-free services, PocketGuard stands out as a reliable tool for individuals seeking to take control of their finances effortlessly through a mobile app. Whether tracking cash flow or devising a debt payoff plan, this application caters to various financial needs effectively.

4. Goodbudget: Best for Envelope Budgeting Method

Manage your finances effectively using Goodbudget’s intuitive envelope system. Allocate your money into different categories or envelopes, providing you with a clear visual representation of where your funds are going. This method helps you stay on top of your expenses and make informed financial decisions.

With Goodbudget, syncing your budget across various devices is seamless. This feature ensures that whether you’re at home or on the go, you have real-time access to your budget and spending data. The convenience of managing your finances from multiple devices can significantly enhance the effectiveness of your budgeting efforts.

The envelope budgeting approach offered by Goodbudget allows for unlimited envelopes, enabling you to create detailed categories for all aspects of your spending. By dividing your money into specific envelopes like groceries, entertainment, or savings, you gain better control over each expense category and can easily track where every dollar goes.

5. Wally: Best for Tracking Expenses

Effortlessly track your expenses by capturing receipts with Wally’s photo feature. The app simplifies expense tracking by visualizing your spending habits through data and charts, offering a clear overview.

Set savings goals within the app to stay motivated and monitor progress efficiently. By having a visual representation of your financial goals, you can better manage your variable expenses and work towards achieving them effectively.

Utilize user reviews to understand how others have successfully used Wally to control their costs. With bill reminders and customizable features, Wally ensures that you are always on top of your financial accounts without missing any payments.

6. EveryDollar: Best for Dave Ramsey Fans

EveryDollar aligns with the budgeting principles advocated by financial guru Dave Ramsey. It enables users to assign each dollar a specific purpose within their monthly budget, promoting intentional spending habits.

The app’s shared budget feature fosters communication and collaboration among family members or spouses regarding financial goals and expenditures. This transparency can enhance accountability and ensure everyone is on the same page financially.

By following Ramsey’s proven strategies through EveryDollar, users can track expenses meticulously, identify areas for improvement, and work towards achieving financial stability. The emphasis on giving every dollar a job helps individuals prioritize saving and eliminate wasteful spending.

Consumer Ratings: Users who are followers of Dave Ramsey’s teachings often rate EveryDollar highly due to its seamless integration of his budgeting philosophy into an easy-to-use platform. The practical approach resonates well with those seeking a structured method to manage their finances effectively.

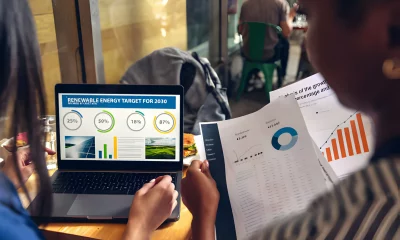

7. Personal Capital: Best for Wealth Management

- Take control of your investments and plan for retirement with Personal Capital.

- Track all your accounts in one place, including bank, credit cards, loans, and investments.

- Utilize Personal Capital’s robust tools for portfolio analysis and investment optimization.

Personal Capital stands out as a top pick for those seeking comprehensive personal finance management solutions. By offering a holistic view of your financial landscape – from day-to-day transactions to long-term investment strategies – this app caters to individuals looking to optimize their financial health efficiently.

With its focus on portfolio performance and investing analytics, Personal Capital empowers users with specific attributes that allow them to make informed decisions regarding their finances. The platform’s ability to aggregate data from various financial institutions enables users to have a consolidated overview of their assets and liabilities conveniently in one place.

Moreover, the app’s emphasis on wealth management goes beyond mere tracking; it provides actionable insights into how users can enhance their financial well-being through strategic planning. Whether you are new to investing or an experienced person looking for advanced tools, Personal Capital offers a user-friendly interface coupled with sophisticated features tailored to meet diverse financial needs effectively.

8. Tiller Money: Best for Spreadsheet Enthusiasts

Customize your budgeting experience effortlessly with Tiller Money’s robust spreadsheets. By automatically importing transactions from various financial institutions into a single location, you can easily track your cash flow and expenses without the hassle of manual entry.

Enjoy the flexibility that Tiller Money offers by allowing you to create personalized budgeting templates and reports tailored to your specific financial goals and preferences. This feature empowers users to have full control over their budgeting process, ensuring a seamless experience that aligns perfectly with individual needs.

With Tiller Money, spreadsheet enthusiasts can take advantage of its user-friendly interface and powerful functionalities to manage their finances efficiently. By providing an unlimited number of customization options, this app caters to both beginners looking for simplicity in tracking expenses as well as experts seeking advanced tools for comprehensive financial management.

9. Simplifi by Quicken: Best for Customizable Budgeting

Tailor your budget effortlessly with Simplifi by Quicken to align perfectly with your financial objectives. This app offers a holistic view of your finances, encompassing bills, accounts, and spending patterns in real-time.

Simplifi streamlines organization through its automated categorization system, ensuring that you can easily track and manage your expenses without the hassle of manual input. The receipt capture feature further enhances this process.

By leveraging Simplifi’s customizable categories, users can adapt their budget structure to suit their specific needs accurately. The desktop version allows seamless access across various devices for convenient money management on-the-go.

The free plan offered by Simplifi makes it an attractive option for those seeking effective budgeting tools without breaking the bank. With its user-friendly interface and robust features like real-time updates, Simplifi stands out as a top choice for personalized budget control.

10. Honeydue: Best for Couples

Collaborate with your partner effortlessly using the Honeydue app. Share a platform to manage finances together, setting and achieving joint financial goals in real-time.

Stay connected with your significant other’s spending habits through instant transaction notifications. This feature helps both members stay informed and accountable, fostering transparency within the relationship.

With its user-friendly interface, even college students can navigate the app easily to track expenses and savings efficiently. The chat feature allows couples to communicate directly within the app about financial matters, enhancing teamwork towards financial stability.

Summary

You’ve now explored a range of budgeting apps, each offering unique features to help you manage your finances effectively. Whether you prefer daily tracking, zero-based budgeting, or simplified money management, there’s an app tailored to suit your needs. From tracking expenses with Wally to personalized budgeting with Simplifi by Quicken, these apps can revolutionize how you handle your money.

Now armed with this knowledge, it’s time to take action. Choose the app that aligns best with your financial goals and start taking control of your budget today. Remember, the key to financial success lies in actively managing your money, and these apps are powerful tools to support you on your journey towards financial stability and freedom.

Frequently Asked Questions

What makes Mint the best budget app for daily budget management?

Mint stands out for its user-friendly interface and real-time tracking features. It categorizes expenses automatically, provides bill reminders, and offers insights into spending habits to help you stay on top of your finances effortlessly.

Is YNAB suitable for beginners who are new to budgeting?

Yes, YNAB is beginner-friendly with its emphasis on zero-based budgeting. By giving every dollar a job, it helps users prioritize their spending and build healthy financial habits from scratch. The interactive tools make it easy to understand and manage your money effectively.

How does PocketGuard simplify finances compared to other apps?

PocketGuard simplifies finances by consolidating all your financial information in one place. It tracks your income, bills, savings goals, and investments in real time so you can see the big picture easily. Its straightforward approach empowers users to make informed financial decisions quickly.

Why is Goodbudget recommended for those interested in the envelope budgeting method?

Goodbudget follows the traditional envelope system virtually by allocating funds into different virtual envelopes based on categories like groceries or entertainment. This visual representation helps users control their spending effectively by limiting expenditures within each designated category.

How does Wally excel at expense tracking compared to other apps?

Wally shines in expense tracking due to its simplicity and efficiency. Users can log expenses manually or scan receipts effortlessly while gaining insights into their spending patterns over time. With customizable categories and budgets, Wally makes managing expenses a breeze for anyone seeking clarity on their financial health.